Why Frankencoin: Advancing Stablecoin Creation and Governance

The impact of decentralized money creation and how the Frankencoin property of being oracle-free pushes stablecoins to new limits.

The creation of money

Today, money is created by central banks and multiplied by commercial banks. This indirectly determines the resource allocation in the economy. Policy-makers know this and sometimes can’t resist to use capital requirement rules to push a political agenda. They incentivize overinvestment in government bonds and real estate, at the expense of innovation and growth. Just recently, the European parliament decided to do the same for carbon certificates, deviating from the original goal of financial stability.

Tomorrow – thanks to blockchain technology – anyone with eligible collateral can create their own money, thereby decentralizing the resource allocation process and bypassing politics, unlocking unlocks growth and prosperity.

This novel form of money comes in the form of freely transferrable cryptographic tokens bound to the value of an established currency, namely stablecoins.

Why stablecoins?

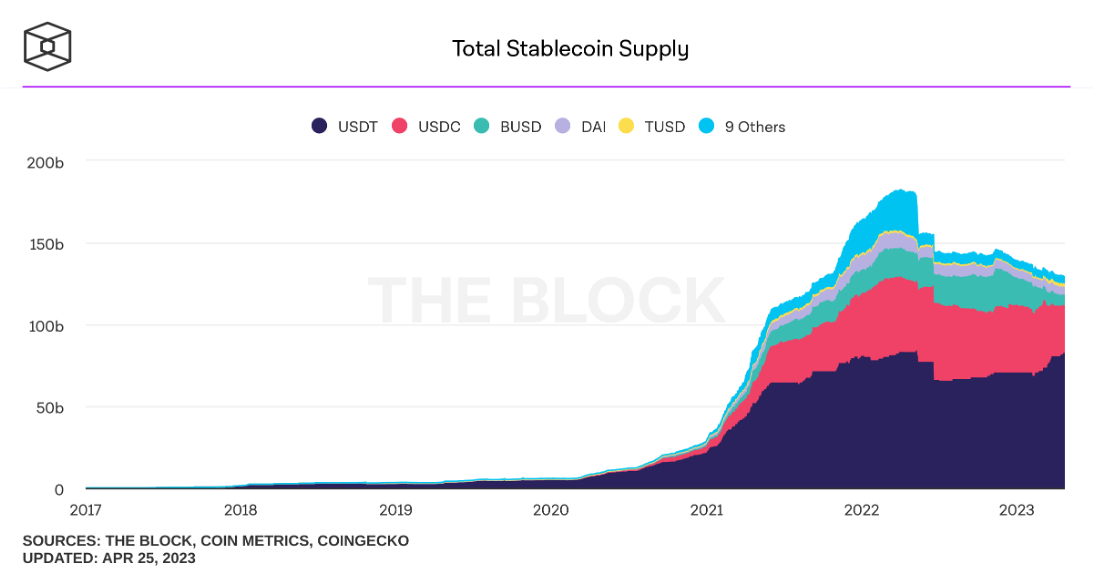

The maturing digital finance landscape with a total market cap of about $2.5 trillion has revealed a critical need for stablecoins. They are necessary in the crypto space due to their ability to store value during periods of high volatility, facilitate seamless movement of capital between exchanges, and enable fast, low-cost, cross-border transactions. This is particularly useful in countries with high inflation rates, where stablecoins can offer a stable and accessible digital currency solution. And most notably, they enable some of the most promising DeFi applications.

Despite their apparent benefits, current stablecoins are not without their shortcomings. The two most popular ones, USCD and USDT (Tether) depend on a centralized issuer. This comes with challenges for transparency and trust. For example, USDC is governed by a consortium of companies that can blacklist addresses and freeze funds. Also the most popular decentralized stablecoin, the DAI, is not as centralized as one would think. It relies on oracles that can potentially be manipulated by actors from outside the system.

The issue with oracles

Virtually every crypto application needs data to operate but it has to get it from a trusted source, and ideally fast and cheap. In crypto, this these third party data providers are called “oracles”. They are often used by stablecoins to determine the value of their collateral or the exchange rate of their pegged currency. If the oracle fails or provides inaccurate data, the stablecoin system may malfunction or become vulnerable to attacks. Frankencoin functions without oracles, and uses a user-driven auction system to determine collateral value.1

In one notable instance, a trading service operating on the Solana blockchain, Mango Markets, fell victim to an intrusion resulting in a loss of $114 million. The breach was executed by artificially inflating the value of a token threefold via the oracle reporting system. Another breach, though smaller in scale, took place at Moola Market, where the core of the attack involved manipulation of the oracle's price information.

Moreover, the market for oracles is quite centralized. Today, a majority of DeFi protocols rely on Chainlink, the most popular oracle provider. According to current estimations, Chainlink has approx. 50-60% market share in verticals like DeFi and gaming.

Why Frankencoin

Frankencoin is designed to address these concerns. It is a decentralized, collateralized stablecoin on Ethereum that tracks the value of the Swiss Franc.

Uniquely, it operates without reliance on oracles, and can be used with a broad range of collateral types. Collateral value is determined by users, not an oracle, and its unique auction-based minting mechanism functions independently of external oracles. This flexibility allows for the use of a wide array of collateral types, provided they have sufficient market availability.2

This makes Frankencoin departure from the traditional stablecoin model by eliminating key weaknesses, offering a more robust, flexible, and democratic stablecoin alternative. Its decentralized nature implies that it operates without a central authority, maintaining functionality even without a traditional legal system. The system's rules and incentives are designed such that anyone can mint new coins or participate in the coin's governance. This is a fundamentally different approach to stablecoin mechanics.

In essence, the Frankencoin system mimics the function of a traditional bank, creating money against collateral. Unlike a bank, there's no need for credit, as users print their own money. All processes are automated and transparent, with no explicit governance beyond a veto mechanism available to significant contributors to the stability reserve.

If you want to dig into the details of how Frankencoin works, you can read more in our documentation here.

How you can contribute

If you’re curious about the details on how Frankencoin works you can read a more detailed documentation here. If you want to try out the protocol, you can do so here.

If you’re a developer interested in the project, please visit us on GitHub and join our discussion there. Please report issues with the smart contract here.

We encourage you to explore the project, ask questions, and share your thoughts with us. Your engagement will play a vital role in the success of the Frankencoin project, and we look forward to working together to create a truly innovative stablecoin.

Thank you for your support, and let's make the Frankencoin project a resounding success!

The name "Frankencoin" hints at both the self-governing nature of the system and the inherent risks tied to launching such a novel mechanism. As it evolves, a deeper understanding of its economic model, governance, and peg maintenance will be imperative to its success and adoption.

Contrary to other collateralized stablecoins, Frankencoin’s liquidation mechanism operates at a slower pace, reducing its suitability for highly volatile collateral types. This trait aids in maintaining stability. However, the system remains experimental and should not be considered an infallible solution.

How’s this project going?